EURO/USD closed at 1.3048 , with 1.3108 being the highest in the week.

On both Weekly and Daily Chart, we do note that the bullish trend are still intact, meaning the uptrend shall continue in upcoming weeks.

Weekly EURO/USD Chart

Daily Chart EURO/USD

Dollars Index Daily Chart

On the weekly chart, the immediate resistance (R3) IS 1.3184, (Just Above the 61.8% Fibo Retr) , and on Daily Chart, its immediate Resistance(R2) is 1.3134., Breaking these two resistances on two time frames shall push up this currency pair towards 1.3660 , near 100 SMA on weekly chart,

However, if you look carefully the Daily Chart, the MACD is showing Bearish Divergence while the PA is still moving up, and the risk of breaking the RSI trend line(in Purple color) and the confirming bearish divergence on Slow Stochastic (9,3,3) MAY indicate Exhausting up-trend near term.

SO PLEASE KEEP A CLOSE WATCH ON BOTH --THE SLOW STOCHASTIC FOR BEARISH DIVERGENCE , AND A POSSIBLE BREAKDOWN ON THE RSI DOWNWARD TREND LINE AS INDICATED.......FOR POSSIBLE MAJOR REVERSAL SIGNALS

On the Dollar index chart, you can note that it is heading south toward immediate support 81.07, below this level may expose 79.60, the current Dollar Index trend is very bearish. My forecast for the dollar index will be 78.00 near term if the present downward momentum persists.

So the uptrend may continue further up but watch out for Reversal near term in region 1.3500-1.3700.

This blog will detail how to create unlimited wealth through Forex/Futures/Commodity and Option Trading

Welcome to my Trading Blog

Disclaimer: This is my personal Blog, reflecting my very own views on Forex , shares and commodity tradings. As such, all informations provided here are barely for information purposes only,. The author should not be held liable for any errors, incomplete information, delayed messages, or for any actions taken in reliance on information contained herein.This blog is new, being established on 06,May.2010. While I am executing trades, posting will be sent simultaneously. The date/Time indicated here is of US Pacific zone(++15 Hours for Singapore/KL/Beijing, Or ++7 hours GMT)

Saturday, July 31, 2010

Further Fundamental Analysis on Euros Strength

In the meantime, the PIIGS are hard at work cutting their deficits for the benefit of the bondholders. Spain, for instance, has cancelled all sorts of public projects, and now Greek and Italy are following suit.

Euro Data released two days ago showed no change in the rate of unemployment across the Eurozone, which stood at 10% during June. Data for consumer price inflation across the Eurozone for July showed a pick up in the rate by three-tenths to 1.7%.

Despite the marginal miss on US GDP, which came in at a slower 2.4% between April and June on an annualized seasonally adjusted basis, the dollar is holding up relatively well. BUT there is a critical effect on weakening Dollars with Bernanke recent statements.::-

Bernanke acknowledged FEW days ago that the US-economy faces an “unusually uncertain time,” but if necessary, he hinted the central bank would resort to “Quantitative Easing,” (QE), or printing vast quantities of US-dollars, in order to prevent a deflationary spiral. With the US federal funds rate pegged near zero-percent, Bernanke was asked by Senator Jim Bunning if the Fed is “out of bullets,” Bernanke responded, “I don’t think so. We are prepared to take further policy actions as needed to foster a return to full utilization of our nation’s productive potential and price stability.”, MEANING keep printing Dollars at maximum capacity...

The yield spread between the US Treasury’s 10-year note, and the German Bund, tumbled by 60-basis points (bps) over the past seven weeks, eroding the value of the US-dollar index by eight-percent. German bund yields bounced slightly above their record lows of 2.50%, after it became increasingly apparent that the ECB is not inclined to cut its 1% repo rate anytime soon. The ECB engineered a recovery of the Euro, from a four-year low of $1.1850, to as high as $1.3045, while traders detected the central bank was phasing out its purchases of Greek and other sovereign debt, at a much earlier than expected date.

FROM THE ABOVE two charts, , you can see that Euros proves to be more responsive to rising bund yield than USDX (dollar index) is to US BOND YIELD.

EURO/USD correlation with German 10- year yield is around 0.900,, vs the -0.60 for the correlation between the USDX and US 10-year yield.

That means Euros/Usd will rise further up in view of the rising German 10-year yield near term.

Euro Data released two days ago showed no change in the rate of unemployment across the Eurozone, which stood at 10% during June. Data for consumer price inflation across the Eurozone for July showed a pick up in the rate by three-tenths to 1.7%.

Despite the marginal miss on US GDP, which came in at a slower 2.4% between April and June on an annualized seasonally adjusted basis, the dollar is holding up relatively well. BUT there is a critical effect on weakening Dollars with Bernanke recent statements.::-

Bernanke acknowledged FEW days ago that the US-economy faces an “unusually uncertain time,” but if necessary, he hinted the central bank would resort to “Quantitative Easing,” (QE), or printing vast quantities of US-dollars, in order to prevent a deflationary spiral. With the US federal funds rate pegged near zero-percent, Bernanke was asked by Senator Jim Bunning if the Fed is “out of bullets,” Bernanke responded, “I don’t think so. We are prepared to take further policy actions as needed to foster a return to full utilization of our nation’s productive potential and price stability.”, MEANING keep printing Dollars at maximum capacity...

However, A so-called EURO bank stress tests,, ,(84/91 passed)which ( propaganda tool ) helped to trigger a 100-bps slide in credit default swaps on Greek bonds, to 825-bps this week, and down sharply from a record 1,320-bps.

With CDS rates on Greece’s debt receding, the demand for the deficit ridden US-dollar has also waned. In addition to the Euro, the biggest winners in the anti US-dollar sweepstakes were the Australian dollar, Swiss franc, and the British pound. China took advantage of the US-dollar’s rally in May, by dumping $32.5-billion of its holdings of US Treasury notes to US$867.7-billion.

The yield spread between the US Treasury’s 10-year note, and the German Bund, tumbled by 60-basis points (bps) over the past seven weeks, eroding the value of the US-dollar index by eight-percent. German bund yields bounced slightly above their record lows of 2.50%, after it became increasingly apparent that the ECB is not inclined to cut its 1% repo rate anytime soon. The ECB engineered a recovery of the Euro, from a four-year low of $1.1850, to as high as $1.3045, while traders detected the central bank was phasing out its purchases of Greek and other sovereign debt, at a much earlier than expected date.

FROM THE ABOVE two charts, , you can see that Euros proves to be more responsive to rising bund yield than USDX (dollar index) is to US BOND YIELD.

EURO/USD correlation with German 10- year yield is around 0.900,, vs the -0.60 for the correlation between the USDX and US 10-year yield.

That means Euros/Usd will rise further up in view of the rising German 10-year yield near term.

GBP/AUD ----- A golden currency pair to bet ??

In view of the lower than expected inflation rate, RBA (Australia) is again expected to keep Rate unchanged. However, we have a Hawkish BOE ( UK) statement on the higher prospect of increasing her Rate near term.

The above contradicting scenario will result in an interesting trade on GBP/AUD., and as usual , AUD is always a target on Risk Aversion.

H4 Chart GBP/USD

On H4, we note that if the PA (Price Action) can break the Ichimoku cloud top resistance near 1.7376, then the next target 1.7543, being its next resistance shall be exposed., follows by higher next target at 1.7815(61.80 % Fibo Ext).

There may be another bad news for AUD,:- Market rumor says the China PMI data might have fallen sharply when August data is released with some predicting a dip for manufacturing beneath the 50-line meaning contraction for the first time in 18 months.

This is a very interesting and rewarding trade, with possibility of over 200 pips gain. You may wait for pull back on upcoming Monday , and looking for the best opportunity to BUY UP.

The above contradicting scenario will result in an interesting trade on GBP/AUD., and as usual , AUD is always a target on Risk Aversion.

H4 Chart GBP/USD

On H4, we note that if the PA (Price Action) can break the Ichimoku cloud top resistance near 1.7376, then the next target 1.7543, being its next resistance shall be exposed., follows by higher next target at 1.7815(61.80 % Fibo Ext).

There may be another bad news for AUD,:- Market rumor says the China PMI data might have fallen sharply when August data is released with some predicting a dip for manufacturing beneath the 50-line meaning contraction for the first time in 18 months.

This is a very interesting and rewarding trade, with possibility of over 200 pips gain. You may wait for pull back on upcoming Monday , and looking for the best opportunity to BUY UP.

Wednesday, July 28, 2010

EURO/USD---Is Euro recent strengthening and its Bullishness Sustainable ??

FUNDAMENTAL ANALYSIS ON EUROS

The growing confidence and excessive evidence of slowing down US economy is driving the Euros now.

Every one got a bit too excited about the idea the euro-area was going to break up and forgot that the US has a whole load of problems of its own,”

Germany leads the way by enforcing Fiscal Balance and tightening spending in the euro, after the EU countries in the region announced budget cuts and the European Union crafted a E750-billion ($970 billion) financial backstop in May to forestall defaults. Spain, Portugal, Ireland and Greece successfully auctioned more than E17 billion of bonds and bills since July 13.

Speculation the recovery would accelerate increased when Germany’s Ifo institute said July 23 that its business climate index unexpectedly jumped to the highest level since July 2007. A composite index of European services and manufacturing industries climbed to 56.7 in July from 56 the month before, London-based Markit Economics said a day earlier.

Even though highly suspicious on the release of the recent STRESS TEST Report, Investors showed little surprise on July 23, when the ECB Officials said seven of 91 EU banks subject to stress tests failed with a combined capital shortfall of only E3.5 billion. The euro rose 0.2% to $1.2933 as of 8:48 am in London, after appreciating in three of th only e past four weeks. The 16-nation currency appreciated 8.9% since June 7, when it slid to $1.1877, the weakest level since March 2006. It also advanced 2.5% since falling to a more than seven-year low on June 29, according to Bloomberg Correlation-Weighted Currency Indexes.

The growing confidence and excessive evidence of slowing down US economy is driving the Euros now.

Every one got a bit too excited about the idea the euro-area was going to break up and forgot that the US has a whole load of problems of its own,”

Germany leads the way by enforcing Fiscal Balance and tightening spending in the euro, after the EU countries in the region announced budget cuts and the European Union crafted a E750-billion ($970 billion) financial backstop in May to forestall defaults. Spain, Portugal, Ireland and Greece successfully auctioned more than E17 billion of bonds and bills since July 13.

Speculation the recovery would accelerate increased when Germany’s Ifo institute said July 23 that its business climate index unexpectedly jumped to the highest level since July 2007. A composite index of European services and manufacturing industries climbed to 56.7 in July from 56 the month before, London-based Markit Economics said a day earlier.

Even though highly suspicious on the release of the recent STRESS TEST Report, Investors showed little surprise on July 23, when the ECB Officials said seven of 91 EU banks subject to stress tests failed with a combined capital shortfall of only E3.5 billion. The euro rose 0.2% to $1.2933 as of 8:48 am in London, after appreciating in three of th only e past four weeks. The 16-nation currency appreciated 8.9% since June 7, when it slid to $1.1877, the weakest level since March 2006. It also advanced 2.5% since falling to a more than seven-year low on June 29, according to Bloomberg Correlation-Weighted Currency Indexes.

We have now a reversed Outlook on EURO/USD Citigroup’s euro, region economic surprise index reached a three-year high of 131 on May 27. The equivalent US gauge fell to a 16-month low of minus 43.6 on July 1. The measures examine historical standard deviations of data surprises by comparing releases with Bloomberg median estimates | |||

| Goldman Sachs analysts reversed their outlook for the euro twice in two months, and said in the most recent forecast that the dollar will weaken against the euro by January as US growth slows. The New York-based bank says the shared currency will reach $1.22 in three months, $1.35 in six months and $1.38 in a year. The main positives for the euro have been stronger-than-expected euro economic numbers and a recovery in risk appetite.However, we still insist that while US growth has slowed more than forecast, the economy will still outpace Europe over the coming year as budget cuts start to brake the recovery The US economy will expand 3.1% this year, according to the median of 55 analyst forecasts compiled by Bloomberg. The euro-region will grow 1.1%, a separate median estimate shows. German Chancellor Angela Merkel’s Cabinet approved four years of budget reductions and revenue programmes worth E81.6 billion on July 7. Greece aims to cut its budget deficit to 8.1% of gross domestic product this year, from 13.6% in 2009, and meet the EU’s 3% limit by 2014. Portugal plans to reach the EU target by 2012, reducing it from 9.4% last year. The euro-region deficit will narrow to 6.1% of the GDP in 2011 from 6.6% this year, according to European Commission forecasts on May 5. The US gap will hit 10% in 2010 and 9.9% next year, the figures show. While European governments are pruning, US President Barack Obama signed into law a $34 billion extension of unemployment benefits on July 22. As I am a strong advocate for Fiscal Balance, Any country which can EARN more than her Spending, then her respective currency strength will be awarded by All investors. AND unfortunately, US is out of this category. The FED is now printing the Dollars 25 Hours /Day. For Europe, it may be painful in the short-term, but they are dealing with it. The US, which has a much bigger problem, isn’t even beginning to deal with it. Summary: NEAR TERM, EURO/USD Shall Hover near 1.3500, and by end of this year 2010 to reach 1.4000. | |||

Monday, July 26, 2010

EURO/USD---1.3700 or below 1.2300 ?

Euro/Usd continues to be an interesting currency pair to be closely watched.

After the highly suspected European Bank Stress Test release follows by the surprised US encouraging new home sales data , so what will be in store next to result in its next Big Move ??

Basing on Technicals, looking at Both the H4 /Daily charts with Trend line(drawn in Purple color), we can spot that breaking the Resistance 1.3085 may expose the next 1.3741(1.618 Fibo Ext. on Daily Chart.) , and do note that the presence of various Bullish Engulfing candles are telling the stories better than words on recent movements., The present bullish bias may persist for longer periods.

However, on the Downside, on Daily chart, breaking below the Ichimoku Cloud top near 1.2770 ,may send this currency pair towards the next possible support near 1.2300, the 38.2% Fibo Retr level and also the same location for the Ichimoku Cloud Bottom resistance line.

H4 E/U with Trendline

Daily E/U with trend line

Daily E/U with Ichimoku

H4 E/U with analysis on Prices/ Range movement

I would like to quote the followings from JIM O'Neill from Goldman Sachs:--

“Foreign exchange is the world’s biggest fruit and vegetable store, with millions of people playing it 24 hours a day,” Goldman Sachs Chief Global Economist Jim O’Neill said on July 21 in a radio interview with Tom Keene on Bloomberg Surveillance. “Anybody who thinks they can get foreign exchange right all the time should be in a lunatic asylum.”

""Unquote,

HAPPY TRADING...

After the highly suspected European Bank Stress Test release follows by the surprised US encouraging new home sales data , so what will be in store next to result in its next Big Move ??

Basing on Technicals, looking at Both the H4 /Daily charts with Trend line(drawn in Purple color), we can spot that breaking the Resistance 1.3085 may expose the next 1.3741(1.618 Fibo Ext. on Daily Chart.) , and do note that the presence of various Bullish Engulfing candles are telling the stories better than words on recent movements., The present bullish bias may persist for longer periods.

However, on the Downside, on Daily chart, breaking below the Ichimoku Cloud top near 1.2770 ,may send this currency pair towards the next possible support near 1.2300, the 38.2% Fibo Retr level and also the same location for the Ichimoku Cloud Bottom resistance line.

H4 E/U with Trendline

Daily E/U with trend line

Daily E/U with Ichimoku

H4 E/U with analysis on Prices/ Range movement

I would like to quote the followings from JIM O'Neill from Goldman Sachs:--

“Foreign exchange is the world’s biggest fruit and vegetable store, with millions of people playing it 24 hours a day,” Goldman Sachs Chief Global Economist Jim O’Neill said on July 21 in a radio interview with Tom Keene on Bloomberg Surveillance. “Anybody who thinks they can get foreign exchange right all the time should be in a lunatic asylum.”

""Unquote,

HAPPY TRADING...

Sunday, July 25, 2010

GBP/JPY ---a next Super Star of FX ?

The imminent rising strength on British pound and the "Apparent Weakness" of the Yen shall yield maximum pips for FX Traders. All Technicals are pointing Bullishness near term.

On Daily Chart, breaking the Ichimoku Cloud Top resistance near 136.33 shall send this currency pair going beyond 141.67 (50 % Fibo Retr, from 126.67 low to 156.76 high, on WEEKLY Chart)

Daily Chart GBP/JPY

H4 GBP/JPY

STRATEGY

BUY near 135 (near its first resistance on H4 )

Target: ; First Target: 136.30, follows by 141.67 next

On Daily Chart, breaking the Ichimoku Cloud Top resistance near 136.33 shall send this currency pair going beyond 141.67 (50 % Fibo Retr, from 126.67 low to 156.76 high, on WEEKLY Chart)

Daily Chart GBP/JPY

H4 GBP/JPY

STRATEGY

BUY near 135 (near its first resistance on H4 )

Target: ; First Target: 136.30, follows by 141.67 next

EURO/JPY--- Bullish near terms ?

Technically, EURO/JPY should head for further North near term.

On H4, 113.37 ( the recent high) should be tested shortly,

On Daily Chart, 114.38 ( 100% Fibo Ext) is its next resistance., follows by 117.90 being the Ichimoku Cloud Top Resistance.

H4 Euro/ Jpy Chart

Daily Euro/Jpy Chart

STRATEGY

BUY near 112.50 (the Pivot level on Daily Chart)

Target: 113.35, follows by 114.35, then 117.90

On H4, 113.37 ( the recent high) should be tested shortly,

On Daily Chart, 114.38 ( 100% Fibo Ext) is its next resistance., follows by 117.90 being the Ichimoku Cloud Top Resistance.

H4 Euro/ Jpy Chart

Daily Euro/Jpy Chart

STRATEGY

BUY near 112.50 (the Pivot level on Daily Chart)

Target: 113.35, follows by 114.35, then 117.90

USD/JPY----- Is it ready to go North ??

Technically, Usd/Jpy has shown its Bottom Formation last week, and is ready for an upward Journey now. I would not speculate on the Currency Intervention by BOJ, but my opinion should base on Technicals Strictly.

If the present upward lift can clear the Ichimoku Cloud Top near 87.70 on H4 Chart, which is also the 50% Fibo Ext. Level, ,,then next resistance at 88.00(38.2% Fibo Ext. LEVEL) may be exposed,,, follows by 88.45 (23.8% Fibo Ext) next., then 89.10 (0.00 % Fibo Ext ) on H4 chart.

H4 USD/JPY

STRATEGY

BUY USD/JPY near 87.35-87.40 (its 61.80% Fibo Ext) on H4 Chart

TARGET: First Target: 88.00, follows by 88.40, then 89.10 next ( 0.00% Fibo Ext) on H4

If the present upward lift can clear the Ichimoku Cloud Top near 87.70 on H4 Chart, which is also the 50% Fibo Ext. Level, ,,then next resistance at 88.00(38.2% Fibo Ext. LEVEL) may be exposed,,, follows by 88.45 (23.8% Fibo Ext) next., then 89.10 (0.00 % Fibo Ext ) on H4 chart.

H4 USD/JPY

STRATEGY

BUY USD/JPY near 87.35-87.40 (its 61.80% Fibo Ext) on H4 Chart

TARGET: First Target: 88.00, follows by 88.40, then 89.10 next ( 0.00% Fibo Ext) on H4

NZD/USD-----When will its upward momentum be halted ??

Nzd/Usd touched 0.7300 last week.

On Daily Chart, the Bullish Divergence may indicate the possibility of further upward momentum near the next resistance 0.7321 which may be the upper limit near term on Daily Chart.

On Both H4 and Daily Chart, You may spot the Double Tops Formation is in the Making, whereby the 0.7300 may be the limiting level.

Daily Chart

H4 NZD/USD

STRATEGY

SELL Down near 0.7300-0.7320

Target: First Target: 0.7165 (Tenkan-Sen line on Daily Chart)

Second Target: 0.7020 (61.8% Fibo Retr on Daily Chart)

On Daily Chart, the Bullish Divergence may indicate the possibility of further upward momentum near the next resistance 0.7321 which may be the upper limit near term on Daily Chart.

On Both H4 and Daily Chart, You may spot the Double Tops Formation is in the Making, whereby the 0.7300 may be the limiting level.

Daily Chart

H4 NZD/USD

STRATEGY

SELL Down near 0.7300-0.7320

Target: First Target: 0.7165 (Tenkan-Sen line on Daily Chart)

Second Target: 0.7020 (61.8% Fibo Retr on Daily Chart)

AUD/USD----A journey to the South to begin soon ??

Aud /Usd reached 0.8969 highest Last week. The Bullish divergence on both H4 and Daily Chart may indicate the possibility of further upward movement till the next resistance at 0.9011 on Daily Chart .

Basing on Elliot Wave analysis, not shown, the next residual wave may end at near 0.90500 , which is also the Fibo projection of 1.2700 being 0.9025 ( From recent low 0.8083 to recent high 0.8850)

Daily Chart AUD/USD

H4 AUD/USD

Strategy

SELL DOWN on further Lifting movement near 0.9025-0.9050

Target : First Target is 0.8720 (Ichimoku Cloud Top Support on Daily Chart)

Basing on Elliot Wave analysis, not shown, the next residual wave may end at near 0.90500 , which is also the Fibo projection of 1.2700 being 0.9025 ( From recent low 0.8083 to recent high 0.8850)

Daily Chart AUD/USD

H4 AUD/USD

Strategy

SELL DOWN on further Lifting movement near 0.9025-0.9050

Target : First Target is 0.8720 (Ichimoku Cloud Top Support on Daily Chart)

Thursday, July 22, 2010

Updated views on EUROS, YEN, POUNDS and AUD

Intra-day Views on the above four currencies are listed below:-

1.0) Euros

The Euro/Usd was capped at 1.3000 and is awaiting to retrace down to the possible 1.2500 support level shortly. However, the immediate resistance at 1.3000 has not been breached convincingly . A breaking of the level near 1.3000-1.3050 may result in reaching 1.3250 which may be the last residual waves limit.. A bearish downturn can only be confirmed once the LOWER trend line is being convincingly broken into as indicated in the above chart.

2) YEN

85.00 is the important psychological support for USD/JPY. Failure to stop the slide may send the currency pair towards the 80.00 level which is the 1995 Low. It is not likely that the upper trend line can be breached near term. The downward momentum is very strong basing on the current trend.

3) UK Pound

The Gbp/ Usd is now sitting on the lower trend line, with bearish divergence on both RSI/STOCH/MACD , we may expect GBP/USD to test for retracement near 1.4800 soon. Breaking this support may expose 1.4200 as indicated from the above chart.

4) AUD

AUD/USD has breached the upper trend line 0.8850 yesterday, registering a high of 0.8950, and next target at 0.9400 is possible near term , as Bullish divergence are confirming its uptrend.. Any reversal below the rising trend line will signal bearishness.

1.0) Euros

The Euro/Usd was capped at 1.3000 and is awaiting to retrace down to the possible 1.2500 support level shortly. However, the immediate resistance at 1.3000 has not been breached convincingly . A breaking of the level near 1.3000-1.3050 may result in reaching 1.3250 which may be the last residual waves limit.. A bearish downturn can only be confirmed once the LOWER trend line is being convincingly broken into as indicated in the above chart.

2) YEN

85.00 is the important psychological support for USD/JPY. Failure to stop the slide may send the currency pair towards the 80.00 level which is the 1995 Low. It is not likely that the upper trend line can be breached near term. The downward momentum is very strong basing on the current trend.

3) UK Pound

The Gbp/ Usd is now sitting on the lower trend line, with bearish divergence on both RSI/STOCH/MACD , we may expect GBP/USD to test for retracement near 1.4800 soon. Breaking this support may expose 1.4200 as indicated from the above chart.

4) AUD

AUD/USD has breached the upper trend line 0.8850 yesterday, registering a high of 0.8950, and next target at 0.9400 is possible near term , as Bullish divergence are confirming its uptrend.. Any reversal below the rising trend line will signal bearishness.

Wednesday, July 21, 2010

USD/JPY----It goes Down and Down, will it stop below 85 only BOJ knows..

USD/ JPY is a very interesting and rewarding FX pair to be traded.

Please see the below charts and the following comments:

H4 Chart USD/JPY , showing its narrowing trading range

Daily Chart, showing the longer term Movement

Please refer to my recent postings on the YEN , its strengthening background due to risk aversion, as more Dollars and Euros are being dumped into YEN for safe heaven purpose.

In view of the fact that Mr. Kan's Seat is still shaky( Japanese PM ) , he may not have time to think over the Intervention process for BOJ. as such , the probability of BOJ forcing down Yen strength is rather slim near term.

Traders are now very worried over the imminent BOJ move, as can be seen from the above H4 chart, the trading range has been narrowing over the past two weeks.

Looking at the Daily chart above, indicators are confirming near term bearishness. The plunge below the psychological level 85.00 will be sooner than expected. As there is no more meaningful support between the present level and 85.00.

Trading Strategy

SELL down USD/JPY is to be continued

PUT on Trailing Stops (Critical) (In case of Intervention by BOJ)

SL===70 PIPS (Average Range)

Target: Just above 85.00

NOTE: You may use the same principles to trade Euro/jpy, GBP/jpy, but study the YEN strength with respective to the strength of GBP and Euros.

Further Note: euro/j, gbp/j , usd/j are ALL VERY PROFITABLE PAIRS TO BE TRADED RIGHT NOW

HAPPY TRADING

Please see the below charts and the following comments:

H4 Chart USD/JPY , showing its narrowing trading range

Daily Chart, showing the longer term Movement

Please refer to my recent postings on the YEN , its strengthening background due to risk aversion, as more Dollars and Euros are being dumped into YEN for safe heaven purpose.

In view of the fact that Mr. Kan's Seat is still shaky( Japanese PM ) , he may not have time to think over the Intervention process for BOJ. as such , the probability of BOJ forcing down Yen strength is rather slim near term.

Traders are now very worried over the imminent BOJ move, as can be seen from the above H4 chart, the trading range has been narrowing over the past two weeks.

Looking at the Daily chart above, indicators are confirming near term bearishness. The plunge below the psychological level 85.00 will be sooner than expected. As there is no more meaningful support between the present level and 85.00.

Trading Strategy

SELL down USD/JPY is to be continued

PUT on Trailing Stops (Critical) (In case of Intervention by BOJ)

SL===70 PIPS (Average Range)

Target: Just above 85.00

NOTE: You may use the same principles to trade Euro/jpy, GBP/jpy, but study the YEN strength with respective to the strength of GBP and Euros.

Further Note: euro/j, gbp/j , usd/j are ALL VERY PROFITABLE PAIRS TO BE TRADED RIGHT NOW

HAPPY TRADING

Tuesday, July 20, 2010

USD/CAD ---- Another profitable trade on the eve of Canada's Rate revision ??

In view of the persistent weakness of Dollars recently, the upcoming rate revision from BOC ( Today 09:00 EST ) which may present to all forex Traders with another golden opportunity on USD/CAD .

We do note that USD/CAD has moved up over 300 pips over the last three trading days, that is rather abnormal without much convincing technical /Fundamental supports.

On H4, breaking below 1.0475, being the Ichimoku Cloud Top would signal its rapid plunging towards 1.0391 (its 38.2% Fibo Retr,), follows by 1.0274 (its recent low)

Strategy

SELL Down near 1.0530 ( near its pivot,, on slight recovery)

SL==60 PIPS

Target: 1.0390, follows by 1.0270

H4 Chart of usd/cad

We do note that USD/CAD has moved up over 300 pips over the last three trading days, that is rather abnormal without much convincing technical /Fundamental supports.

On H4, breaking below 1.0475, being the Ichimoku Cloud Top would signal its rapid plunging towards 1.0391 (its 38.2% Fibo Retr,), follows by 1.0274 (its recent low)

Strategy

SELL Down near 1.0530 ( near its pivot,, on slight recovery)

SL==60 PIPS

Target: 1.0390, follows by 1.0270

H4 Chart of usd/cad

Monday, July 19, 2010

GBP/CAD---An Interesting Star-Trade of the Day ??

In view of the imminent weakness of British Pounds and the upcoming rate revision from BOC , coupled with the recent rise of the pair, we reckon that it may be the star of trading for today.

Please note that BOC is expected to increase her interest rate from 0.50 to 0.75 today (09:00 EST)

H1 Chart for GBP/CAD

H4 Chart for GBP/CAD

From the H4 chart, a perfect Double top FORMATION is being finalized.. A rise of almost 750 pips over the last few days can be noted too on H4.

From the H1 chart, a break below 1.5950, ( near both the 100 SMA and Ichimoku Cloud bottom )shall see this pair charging towards 1.5415 (its recent low) and beyond.(see also H4 Chart)

Strategy

SELL DOWN GBP/USD near 1.6040 (slight recovery)

SL===60 PIPS

Target: 1.5950(H1, 100 SMA), follows by 1.5813 (H4, Ichimoku Top), and 1.5418 (H4, Recent Low)

Please note that you may have the potential to gain over 600 pips

Please note that BOC is expected to increase her interest rate from 0.50 to 0.75 today (09:00 EST)

H1 Chart for GBP/CAD

H4 Chart for GBP/CAD

From the H4 chart, a perfect Double top FORMATION is being finalized.. A rise of almost 750 pips over the last few days can be noted too on H4.

From the H1 chart, a break below 1.5950, ( near both the 100 SMA and Ichimoku Cloud bottom )shall see this pair charging towards 1.5415 (its recent low) and beyond.(see also H4 Chart)

Strategy

SELL DOWN GBP/USD near 1.6040 (slight recovery)

SL===60 PIPS

Target: 1.5950(H1, 100 SMA), follows by 1.5813 (H4, Ichimoku Top), and 1.5418 (H4, Recent Low)

Please note that you may have the potential to gain over 600 pips

Sunday, July 18, 2010

EURO/USD----TO HEAD BACK TO 1.18 and Parity near terms ??

Technicals:

EURO/USD jumped below the Tenkan-sen line on H4 CHART during the asia session Open,.the next support is at the Kijun-sen near 1.2822, (also the 61.8% Fibo Retr on H4)

Breaking below the 1.2822, may expose the next support near 1.2630 at the Ichimoku cloud top (Also near the 23.6 % Fibo Retr), on H4

At the moment of writing this post, both RSI / STOCHASTIC and MACD (on H4) are indicating Bearish Divergence.

1.2877 is the 100 SMA on Daily Chart

H4 E /U Chart

Fundamentals

Euro/Usd has enjoyed its reversal near 1.3000-1.3010 from its Low at 1.1872 for the past few weeks.. Many has even envisaged that the 1.3500 can be the next Target. However, if you are the regular follower of my blog, you do note that i am always looking for opportunity to SELL down the Euro/Usd, as my mid /longer term view on this currency pair is Bearish.

Many are laughing at my opinion on the Intervention of Euro Central Banks to BUY UP Euros over the last few weeks to enable survival of the Euro Union., and my views on the possible Split up of the Entire Euros Union mid term is still valid..

Currency Strength is relative. We do note that there are LESS bad News from Euros as compared to Dollars which seems to be flooded with Negative News recently, , such as downgrading of GDP and Unemployment forecast of US Ecomomy from FOMC, lower CPI recent release,etc, etc. But relatively, The problems in Europe is far too complex and explosive as compared to US mid term. The upcoming release on the banking STRESS Test this Friday may not carry much weight on the existing Bearish scenario on Euros.

The recent SUCCESSFUL bidding for Spanish Bonds to signal Euros recovery is utterly nonsense in my opinion, as the real buyers are from the CENTRAL Banks?

We measure Currency strength basing on her Fiscal Balance, GDP, CPI, Unemployment data, and growth progress. And do remember, Investors will reward ANY country with Fiscal Balance, such as CHF and SGD, ON European Union, besides Germany (Euros' Boss) Showing positive results, all others are either neutral or on the brink of collapse, ALL data can be extracted from their respective Statistics Departments(Euros), or their trades offices.

I would like to extract the following write-up for sharing (Without modulation) from (Via Morgan Stanley, FX Pulse, Stephen Hull, 15 July 2010)

or you may go to this link to get the full articles :http://www.businessinsider.com/morgan-stanley

QUOTE""

EURO/USD jumped below the Tenkan-sen line on H4 CHART during the asia session Open,.the next support is at the Kijun-sen near 1.2822, (also the 61.8% Fibo Retr on H4)

Breaking below the 1.2822, may expose the next support near 1.2630 at the Ichimoku cloud top (Also near the 23.6 % Fibo Retr), on H4

At the moment of writing this post, both RSI / STOCHASTIC and MACD (on H4) are indicating Bearish Divergence.

1.2877 is the 100 SMA on Daily Chart

H4 E /U Chart

Fundamentals

Euro/Usd has enjoyed its reversal near 1.3000-1.3010 from its Low at 1.1872 for the past few weeks.. Many has even envisaged that the 1.3500 can be the next Target. However, if you are the regular follower of my blog, you do note that i am always looking for opportunity to SELL down the Euro/Usd, as my mid /longer term view on this currency pair is Bearish.

Many are laughing at my opinion on the Intervention of Euro Central Banks to BUY UP Euros over the last few weeks to enable survival of the Euro Union., and my views on the possible Split up of the Entire Euros Union mid term is still valid..

Currency Strength is relative. We do note that there are LESS bad News from Euros as compared to Dollars which seems to be flooded with Negative News recently, , such as downgrading of GDP and Unemployment forecast of US Ecomomy from FOMC, lower CPI recent release,etc, etc. But relatively, The problems in Europe is far too complex and explosive as compared to US mid term. The upcoming release on the banking STRESS Test this Friday may not carry much weight on the existing Bearish scenario on Euros.

The recent SUCCESSFUL bidding for Spanish Bonds to signal Euros recovery is utterly nonsense in my opinion, as the real buyers are from the CENTRAL Banks?

We measure Currency strength basing on her Fiscal Balance, GDP, CPI, Unemployment data, and growth progress. And do remember, Investors will reward ANY country with Fiscal Balance, such as CHF and SGD, ON European Union, besides Germany (Euros' Boss) Showing positive results, all others are either neutral or on the brink of collapse, ALL data can be extracted from their respective Statistics Departments(Euros), or their trades offices.

I would like to extract the following write-up for sharing (Without modulation) from (Via Morgan Stanley, FX Pulse, Stephen Hull, 15 July 2010)

or you may go to this link to get the full articles :http://www.businessinsider.com/morgan-stanley

QUOTE""

Morgan Stanley:

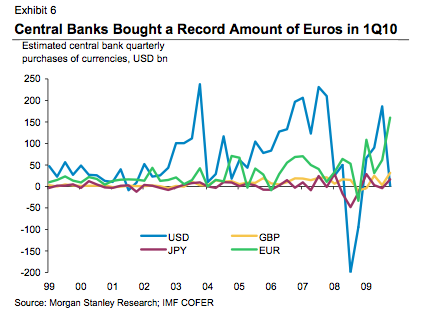

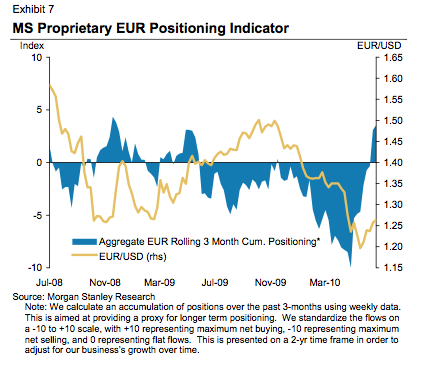

Overall, with the euro now trading rich to fair value against the dollar and on a trade-weighted basis, we think many of the factors that have undermined the euro so far in 2010 are likely to weigh on it again in the second half. Indeed, if there are growing risks that US growth disappoints, then the same is likely to happen to the Eurozone, especially as fiscal policy is being tightened in Europe....Our analysis of Eurozone capital flows through the broad basic balance of payments reveals that the demand for euros has weakened significantly so far this year and is much weaker than we anticipated with a lack on bond inflows being the primary factor (Exhibit 5). A weaker BBoP combined with evidence from the IMF COFER data that central banks were very big buyers of euros (USD 160bn) in Q1 as they kept their allocations of euros stable suggests to us that the euro is unlikely to rally much further (Exhibit 6).Our proprietary positioning indicator (which we are going to release for all currencies shortly) reveals that the market has probably cleared out its short euro position over recent weeks (Exhibit 7).

(Via Morgan Stanley, FX Pulse, Stephen Hull, 15 July 2010)

They've now doubled their short against the euro to 20% of their model portfolio, though with a stop-loss set at $1.34. Their target for the EUR/USD is set at a whopping $1.18.

unquote""

I hope the above write-up by Hull can give you more insight on EURO/USD.

HAPPY TRADING

JPY Crosses---STARS of FX Tradings for Upcoming Weeks ??

As upward momentum is likely to continue for the Strengthening YEN in upcoming weeks, we reckon that trading the YEN crosses should be profitable and rewarding .

We will look at Three YEN pairs, namely, 1) Euro/Jpy,,,, 2)Usd/Jpy,,, 3) Gbp/Jpy

1) E / J

Daily Chart E/J

H4 Chart E/J

From the Daily Chart, If the upcoming candle breaches the Tenkan-sen at 111.15, and further below the Kijun-sen at 110.32, Then it shall expose 107.26 (Its recent Low, also the 100.00 Fibo line)

Strategy:

SELL Down EURO/JPY on recovery near 113.00 (Ichimoku Bottom)

SL==70 PIPS

Target: Point: 110.20, then 107.00 next

2) U / J

H4 U/J Chart

H1 U/J Chart

From the H1 chart, if the next candle breaks the immediate support at 86.50, then it shall expose the next level at 86,26 (its recent low ), then it may go further down to the Nov/15/2009 low at 84.75

Strategy

SELL Down U / J on recovery near 86.90,{ Kijun-sen resistance), on H1,

SL==50 PIPS

Target Point =86.30,, follows by 84.70 (15/ N0v/2009 Low)

3) GBP/JPY

H4 G /J Chart

H1 G / J Chart

On the H4 chart, breaking the 131.24 (Also the 0.00% Fibo Retr line) shall expose 126,68 ( May 20, Low)

On H1, recovery near 132.80 (the Tenkan-sen Line) shall see renewed Selling .down on this G /J Pair.

Strategy

SELL Down on Recovery near 132.80

SL==60 PIPS

Target: : 131.20, follows by 126.00

A word of CAUTION on trading JPY Crosses

Please be warned that in view of the fact that continual appreciation of YEN may not be welcome by BOJ, the possibility of Forex Intervention by BOJ cannot be discarded., even though the probability is rather Low near term. Just keep this information in mind while trading YEN Crosses.

HAPPY TRADING

We will look at Three YEN pairs, namely, 1) Euro/Jpy,,,, 2)Usd/Jpy,,, 3) Gbp/Jpy

1) E / J

Daily Chart E/J

H4 Chart E/J

From the Daily Chart, If the upcoming candle breaches the Tenkan-sen at 111.15, and further below the Kijun-sen at 110.32, Then it shall expose 107.26 (Its recent Low, also the 100.00 Fibo line)

Strategy:

SELL Down EURO/JPY on recovery near 113.00 (Ichimoku Bottom)

SL==70 PIPS

Target: Point: 110.20, then 107.00 next

2) U / J

H4 U/J Chart

H1 U/J Chart

From the H1 chart, if the next candle breaks the immediate support at 86.50, then it shall expose the next level at 86,26 (its recent low ), then it may go further down to the Nov/15/2009 low at 84.75

Strategy

SELL Down U / J on recovery near 86.90,{ Kijun-sen resistance), on H1,

SL==50 PIPS

Target Point =86.30,, follows by 84.70 (15/ N0v/2009 Low)

3) GBP/JPY

H4 G /J Chart

H1 G / J Chart

On the H4 chart, breaking the 131.24 (Also the 0.00% Fibo Retr line) shall expose 126,68 ( May 20, Low)

On H1, recovery near 132.80 (the Tenkan-sen Line) shall see renewed Selling .down on this G /J Pair.

Strategy

SELL Down on Recovery near 132.80

SL==60 PIPS

Target: : 131.20, follows by 126.00

A word of CAUTION on trading JPY Crosses

Please be warned that in view of the fact that continual appreciation of YEN may not be welcome by BOJ, the possibility of Forex Intervention by BOJ cannot be discarded., even though the probability is rather Low near term. Just keep this information in mind while trading YEN Crosses.

HAPPY TRADING

Subscribe to:

Comments (Atom)