EURO/USD jumped below the Tenkan-sen line on H4 CHART during the asia session Open,.the next support is at the Kijun-sen near 1.2822, (also the 61.8% Fibo Retr on H4)

Breaking below the 1.2822, may expose the next support near 1.2630 at the Ichimoku cloud top (Also near the 23.6 % Fibo Retr), on H4

At the moment of writing this post, both RSI / STOCHASTIC and MACD (on H4) are indicating Bearish Divergence.

1.2877 is the 100 SMA on Daily Chart

H4 E /U Chart

Fundamentals

Euro/Usd has enjoyed its reversal near 1.3000-1.3010 from its Low at 1.1872 for the past few weeks.. Many has even envisaged that the 1.3500 can be the next Target. However, if you are the regular follower of my blog, you do note that i am always looking for opportunity to SELL down the Euro/Usd, as my mid /longer term view on this currency pair is Bearish.

Many are laughing at my opinion on the Intervention of Euro Central Banks to BUY UP Euros over the last few weeks to enable survival of the Euro Union., and my views on the possible Split up of the Entire Euros Union mid term is still valid..

Currency Strength is relative. We do note that there are LESS bad News from Euros as compared to Dollars which seems to be flooded with Negative News recently, , such as downgrading of GDP and Unemployment forecast of US Ecomomy from FOMC, lower CPI recent release,etc, etc. But relatively, The problems in Europe is far too complex and explosive as compared to US mid term. The upcoming release on the banking STRESS Test this Friday may not carry much weight on the existing Bearish scenario on Euros.

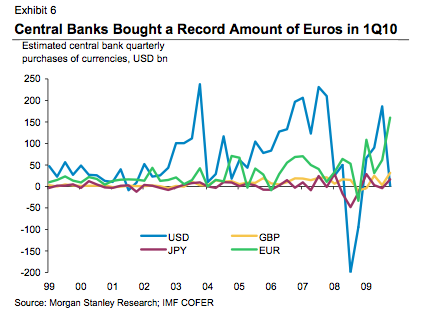

The recent SUCCESSFUL bidding for Spanish Bonds to signal Euros recovery is utterly nonsense in my opinion, as the real buyers are from the CENTRAL Banks?

We measure Currency strength basing on her Fiscal Balance, GDP, CPI, Unemployment data, and growth progress. And do remember, Investors will reward ANY country with Fiscal Balance, such as CHF and SGD, ON European Union, besides Germany (Euros' Boss) Showing positive results, all others are either neutral or on the brink of collapse, ALL data can be extracted from their respective Statistics Departments(Euros), or their trades offices.

I would like to extract the following write-up for sharing (Without modulation) from (Via Morgan Stanley, FX Pulse, Stephen Hull, 15 July 2010)

or you may go to this link to get the full articles :http://www.businessinsider.com/morgan-stanley

QUOTE""

Morgan Stanley:

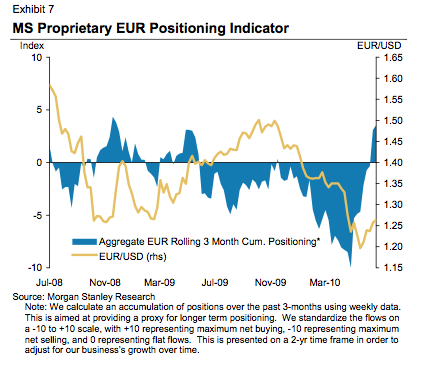

Overall, with the euro now trading rich to fair value against the dollar and on a trade-weighted basis, we think many of the factors that have undermined the euro so far in 2010 are likely to weigh on it again in the second half. Indeed, if there are growing risks that US growth disappoints, then the same is likely to happen to the Eurozone, especially as fiscal policy is being tightened in Europe....Our analysis of Eurozone capital flows through the broad basic balance of payments reveals that the demand for euros has weakened significantly so far this year and is much weaker than we anticipated with a lack on bond inflows being the primary factor (Exhibit 5). A weaker BBoP combined with evidence from the IMF COFER data that central banks were very big buyers of euros (USD 160bn) in Q1 as they kept their allocations of euros stable suggests to us that the euro is unlikely to rally much further (Exhibit 6).Our proprietary positioning indicator (which we are going to release for all currencies shortly) reveals that the market has probably cleared out its short euro position over recent weeks (Exhibit 7).

(Via Morgan Stanley, FX Pulse, Stephen Hull, 15 July 2010)

They've now doubled their short against the euro to 20% of their model portfolio, though with a stop-loss set at $1.34. Their target for the EUR/USD is set at a whopping $1.18.

unquote""

I hope the above write-up by Hull can give you more insight on EURO/USD.

HAPPY TRADING

Hi Alex,

ReplyDeleteI see you wrote this post a few days ago. Now

eur/usd is at 1.28 and above. Do you think euro can break out above 1.3040?

cheers,

ForexGate

Btw I also left you a reply to your comment on my blog.

hi, forexgate,

ReplyDeleteWe will have to see what will be the effect of the Stress Tests reports for the European banks which is to be released on this upcoming Friday.

I think the possibility of reaching 1.3250 may be possible with assistance from ECB near term. This level is derived with Elliot Waves tools. 1.3250 may be the last residual pull back level after reaching the recent lows at 1.1870.

My longer term views on euro/usd is still bearish, it may head to parity by end of this year.

i never know the use of adobe shadow until i saw this post. thank you for this! this is very helpful. forex broker list

ReplyDelete